With the proliferation of Conversation AI, Generative AI and Agentic AI into almost every walk of human life, I wanted to explore how this can be and is being leveraged in different industries.

According to OpenAI, Morgan Stanley is leveraging Generative AI (GPT4) to power an internal-facing chatbot that performs a comprehensive search of wealth management content, essentially providing wealth managers the knowledge of the most knowledgeable person in Wealth Management — instantly.

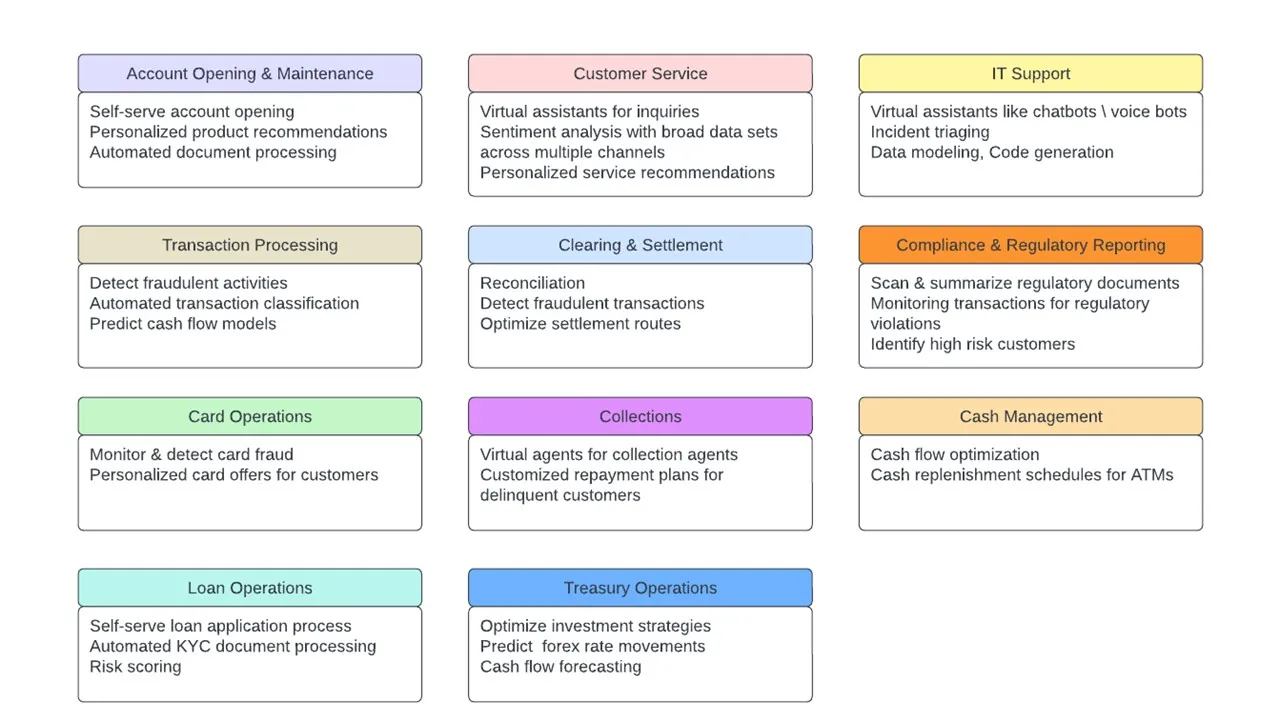

In this article, I will cover how Generative AI can be leveraged in Banking Operations. There are several dimensions that determine these banking functions — geographical region(s) where the bank operates, types of customer (individuals, businesses), products offered, scale of operations and many more. While not an exhaustive list, this should cover a broad spectrum of common banking operation functions.

Account Opening and Maintenance

This involves the process of opening various types of bank accounts (e.g., savings accounts, checking accounts) and maintaining customer information and records.

Intelligent chatbots can engage with potential customers to collect necessary information and guide them through a personalized self serve account opening process. During the account opening process, Generative AI can be leveraged to analyze customer responses and financial profiles to offer personalized product recommendations, such as suitable savings or investment accounts, credit card options, or loan products. Generative AI algorithms can automatically process documents by extracting relevant information from customer-provided documents like identification cards, proof of address, and income statements, automating the data entry process and minimizing errors.

Transaction Processing

Generative AI algorithms can analyze transaction patterns, origin location, user behavior, historical data, and watch lists to detect potential fraudulent activities in real-time. This could aid significantly in payment investigation analysis at scale, covering a broader data set and with speed. Customer transactions can be automatically categorized based on spending patterns, enabling customers to get a clear view of their financial habits and helping banks to offer personalized financial advice. Furthermore, transaction data and cash flow patterns can be analyzed to predict future cash flow needs, helping banks and customers in optimizing cash flow management and planning.

According to OpenAI, Generative AI (GPT4) is being leveraged at Stripe for fraud detection among other use cases.

Clearing and Settlement

Generative AI can efficiently reconcile large volumes of transaction data and accounts, comparing internal records with external sources, such as clearinghouses and other financial institutions. Transaction data can be automatically matched any discrepancies or mismatches can be identified in real-time, significantly reducing the time and effort required for manual reconciliation processes. Furthermore, this transaction data can be analyzed during the clearing and settlement process to identify potential fraudulent activities. If any suspicious transactions are detected, relevant parties can be notified for further investigation and action. This proactive approach helps minimize financial risks and enhances the security of the payment ecosystem. There’s an opportunity to optimize settlement routes by analyzing historical settlement data resulting in faster transactions while reducing settlement costs

Cash Management

Cash demand at various bank branches and ATMs can be predicted. By analyzing historical transaction data and considering external factors like seasonal trends and events, Generative AI models can estimate future cash requirements accurately. Banks can use this information to optimize cash supply, ensuring the right amount of cash is available at the right time and location, and reducing the risk of cash shortages or excess holdings. Based on real-time transaction data and predictive insights, banks can optimize cash replenishment schedules for ATMs and branches. Generative AI can analyze cash flow patterns for individuals and businesses. By identifying trends and fluctuations in cash flow, banks can offer targeted financial advice, such as savings or investment opportunities, to customers. For businesses, this information can be valuable for making strategic financial decisions and managing working capital effectively

Compliance and Regulatory Reporting

Banks continue to see increased regulatory obligations across the world in almost every country. Understanding these regulations and submitting reports to regulators in itself is a time consuming and expensive endeavor. Generative AI models can scan and summarize regulatory documents, guidelines, and updates. By processing large volumes of regulatory content, these models can provide concise summaries and actionable insights, helping compliance teams better understand and implement the necessary regulatory changes. This learning can further be utilized to automate the monitoring of transactions for regulatory requirements violations, ensuring that transactions comply with regulations such as the Bank Secrecy Act (BSA) and the Foreign Account Tax Compliance Act (FATCA). By proactively identifying non-compliant activities, banks can take corrective actions promptly and avoid penalties. By analyzing customer data, transaction patterns, and external data sources, Generative AI models can identify high-risk customers and potential money laundering activities, ensuring that the bank meets regulatory requirements and mitigates risks associated with financial crime.

Customer Service

Banks can implement virtual assistants that interact with customers through webchat or voice calls. These virtual assistants can handle common customer inquiries, such as checking account balances, transaction history, or general banking information. Generative AI models make it easier to integrate natural language understanding to interpret customer queries accurately and provides instant responses, reducing the need for customers to wait for human support. Generative AI can analyze customer feedback and reviews from various sources, such as social media, surveys, and customer support interactions. Through this sentiment analysis, customer satisfaction can be gauged and areas where improvements are needed can be identified. Banks can use these insights to enhance their customer service offerings, address pain points, and improve overall customer experience. Service recommendations can also be personalized based on this analysis.

ABN Amro is using the technology to automatically summarize conversations between bank staff and customers. It’s also using it to help its employees gather data on customers to assist with answering queries and avoid repetitive questions.

Loan Operations

Intelligent virtual assistants can guide customers through a loan application process making it seamless and fully self-serve. Generative AI models can help gather and validate necessary know your customer (KYC) documentation and provide instant feedback on eligibility and potential loan options, improving the overall customer experience. Generative AI models can analyze large amounts of customer data, including credit history, income, and financial behavior, to assess credit risk accurately and predict the likelihood of loan default and assign appropriate risk scores to applicants.

Treasury Operations

Generative AI models can analyze market data, economic indicators, and historical trends to optimize and suggest investment strategies for the bank’s treasury department. Historical currency exchange data and global market trends can be analyzed to predict foreign exchange rate movements. This predictive capability can assist banks in making informed decisions regarding foreign exchange hedging and currency trading, reducing potential currency-related losses and maximizing profits. Generative AI can analyze cash flow data from various sources to forecast future cash flow patterns accurately. This forecasting helps treasury departments optimize liquidity management and plan for potential cash surpluses or deficits, ensuring that the bank has sufficient funds to meet its financial obligations.

Card Operations

Card transaction patterns, location data, and spending behavior and other indicators can be monitored and analyzed in real time to identify potential instances of card fraud. When suspicious transactions are detected, the system can immediately block the card or trigger alerts for further investigation. This proactive approach helps protect customers from unauthorized access to their accounts and prevents financial losses.

Another benefit of analyzing spending patterns is to generate personalized credit card offers. Generative AI models can identify customers who are likely to be interested in specific credit card features or rewards programs based on their transaction history. By tailoring offers to individual preferences, banks can increase the likelihood of customers accepting and using the credit card, leading to higher card usage and customer satisfaction.

Collections

Managing overdue loan and credit card payments, attempting to recover outstanding amounts, and working with customers on repayment solutions is a critical function. Generative AI models can analyze customer data, credit history, and financial behavior to create customized repayment plans that align with the customer’s ability to pay. Several factors such as income, expenses, and outstanding debt can be considered to suggest repayment schedules that are manageable for the customer. The service itself can be made available to collection agents through a virtual agent. By offering flexible and personalized repayment options, banks can improve customer satisfaction and increase the likelihood of timely debt resolution.

IT Support

Technology being the backbone for every bank in this era, managing and maintaining the bank’s technology infrastructure, including online banking systems, mobile apps, and cybersecurity becomes another critical function in any banking operation. Generative AI can be used to power internal virtual assistants like chatbots and voice bots to answer frequently asked questions. Several helpdesk related activities like resetting a password, unlocking a locked account, providing access to a certain asset like a file or a folder or a database can be handled by Generative AI. IT incident tickets can be automatically categorized and prioritized based on severity and impact. Furthermore, the tickets can be analyzed and triaged with recommendations or be routed to the appropriate team for resolution. This could help streamline the incident management process and accelerate issue resolution.

Generative AI can help IT teams in building initial designs like data models and in code generation. These have proven to augment skillset of IT teams, helping them deliver products faster.

As the adoption of Conversational, Generative & Agentic AI into mainstream banking operations is on the horizon, there are a few low hanging fruits that can accelerate and realize business value faster. Content Summarization, Document Validation and Virtual Assistants fall into this category.